Dec Epoxy Resin Price Climbs on Higher Cost

Introduction: In December, constant price rises of BPA and ECH slightly strengthened cost support for epoxy resin prices. Besides, some epoxy resin producers mainly fulfilled the previous orders and had a relatively low inventory. Downstream plants held wait-and-see sentiments, with some restocking on rigid demand. Therefore, the supply-demand fundamentals turned from loose to slightly tight, and epoxy resin prices continued to grow amid bullish sentiments.

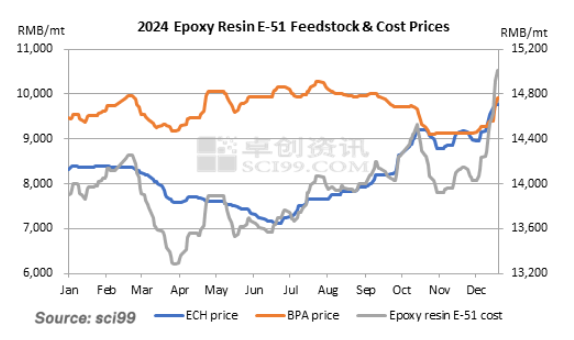

Growing feedstock prices provided greater cost support.

In December, some ECH units in East China were restarted, slightly easing the short ECH supply, while the market spot goods remained relatively tight. Meanwhile, the purchasing from downstream epoxy resin plants was passable, the cost transmission was smooth, and the cost support from feedstock glycerin inched up, so ECH prices climbed notably. As of December 11, ECH prices in East China increased by 4.47% from early December. As for BPA, the market spot supply stayed short due to the below-expected release of some BPA newly added capacity. Besides, downstream PC plants saw relatively high operating rates, and the demand from epoxy resin plants for BPA increased by a small margin, so mainstream BPA prices went up. By December 11, BPA prices in East China grew by 1.91%. On the cost side, up to December 11, the production cost of liquid epoxy resin mounted by RMB 343/mt or 2.44%, indicating enhanced cost support for epoxy resin prices.

The supply-demand fundamentals turned from loose to slightly tight in December.

In early December, market players held bearish sentiments, and approaching the Spring Festival holiday, epoxy resin plants maintained a low inventory, so the overall industrial operating rate was not high amid lower unit loads at sporadic plants. At the beginning of December, the operating rate of liquid epoxy resin stood at 57%, and that of solid epoxy resin was 41% or so. Within the month, the orders from wind turbine blade plants rose somewhat despite some end industries entering an off-peak season. Besides, driven by epoxy resin price rises, the demand from other industries also witnessed improvements. Most epoxy resin plants fulfilled orders, and the market spot supply was limited, followed by an increase in epoxy resin prices. Some downstream plants purchased on rigid demand amid constant price rises, some restocked in advance, and others were cautious about buying.

In terms of the foreign market, a few trade policies were adjusted somewhat. According to the International Trade Administration, on November 29, the U.S. Department of Commerce postponed the deadline for issuing the final determination in the less-than-fair-value (LTFV) investigation of certain epoxy resins from China until March 28, 2025, and extended the provisional measures from four months to a period of not more than six months. There is no significant change in other news, and monthly exports are expected to remain largely stable, with the average monthly export volume remaining at about 20kt.

Epoxy resin prices may inch up in the near term.

On the cost side, ECH prices may fluctuate at highs, and the market spot supply may remain tight with a largely stable operating rate, so ECH prices may be stable-to-increasing in the short term. BPA prices are predicted to inch up due to the low spot goods. Therefore, the cost support for epoxy resin prices may be relatively strong in the near term.

On the supply side, the unit operating rate of sporadic epoxy resin plants may rise slightly, but the market spot goods may be limited, as most plants fulfill the previous orders and the inventory at plants is limited. Some downstream plants are expected to restock on rigid demand, while end demand may be enhanced limitedly, so the overall downstream demand may hardly improve.